Vietnam’s fruit juice export sector has rapidly evolved into one of the country’s most successful agricultural achievements, making significant inroads into the European Union (EU) market. With the EU’s growing appetite for tropical, natural, and sustainable products, Vietnamese companies have become key suppliers of high-quality fruit beverages.

Among these exporters, RITA FOOD & DRINK CO., LTD has emerged as a leading name—recognized not only for export performance but also for its commitment to environmental responsibility through innovations such as the tethered cap initiative.

Key Takeaways

Vietnam exported over 8.5 million kilograms of fruit juice to the EU in 2025, valued at 72.47 million USD.

RITA Beverage ranks Top 1 exporter, leading with quality, sustainability, and innovation.

The main EU destinations are Russia, Poland, France, Spain, Germany, and the Netherlands, representing over 70% of total export value.

Vietnam’s juice producers are increasingly aligning with EU food safety and packaging standards, including the Tethered Cap Directive.

The European beverage market favors natural, tropical, and eco-friendly products—an area where Vietnamese exporters excel.

Vietnam’s Fruit Juice Export Growth to Europe

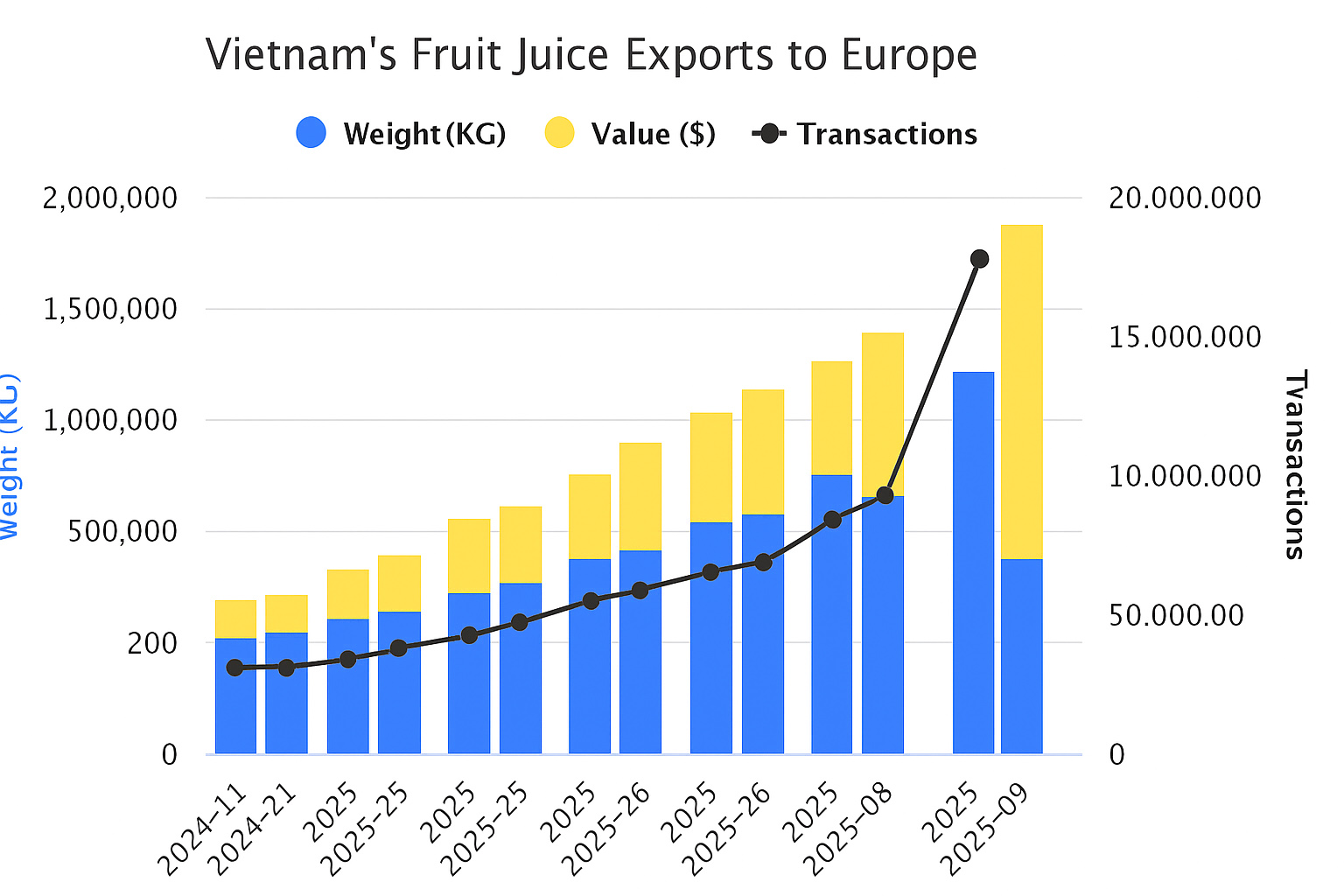

Vietnam’s fruit juice exports to Europe have grown substantially over the past year, positioning the country among Asia’s most dynamic beverage suppliers. The data from late 2024 to September 2025 reveals a steady and consistent upward trend in both volume and value.

In November 2024, Vietnam exported around 151,970 kilograms of juice worth 1.42 million USD. By December 2024, exports jumped to 554,923 kilograms valued at 5.66 million USD, and the pace continued to accelerate throughout 2025. The export value peaked in September 2025 at 16.12 million USD, with a monthly export weight of 2,038,203 kilograms—the highest within the period analyzed.

Across eleven months, Vietnam recorded over 1,911 export transactions, engaging 255 exporters and 526 importers across the continent. The total export volume exceeded 8.5 million kilograms, generating 72.47 million USD in export revenue.

Top Destination Countries

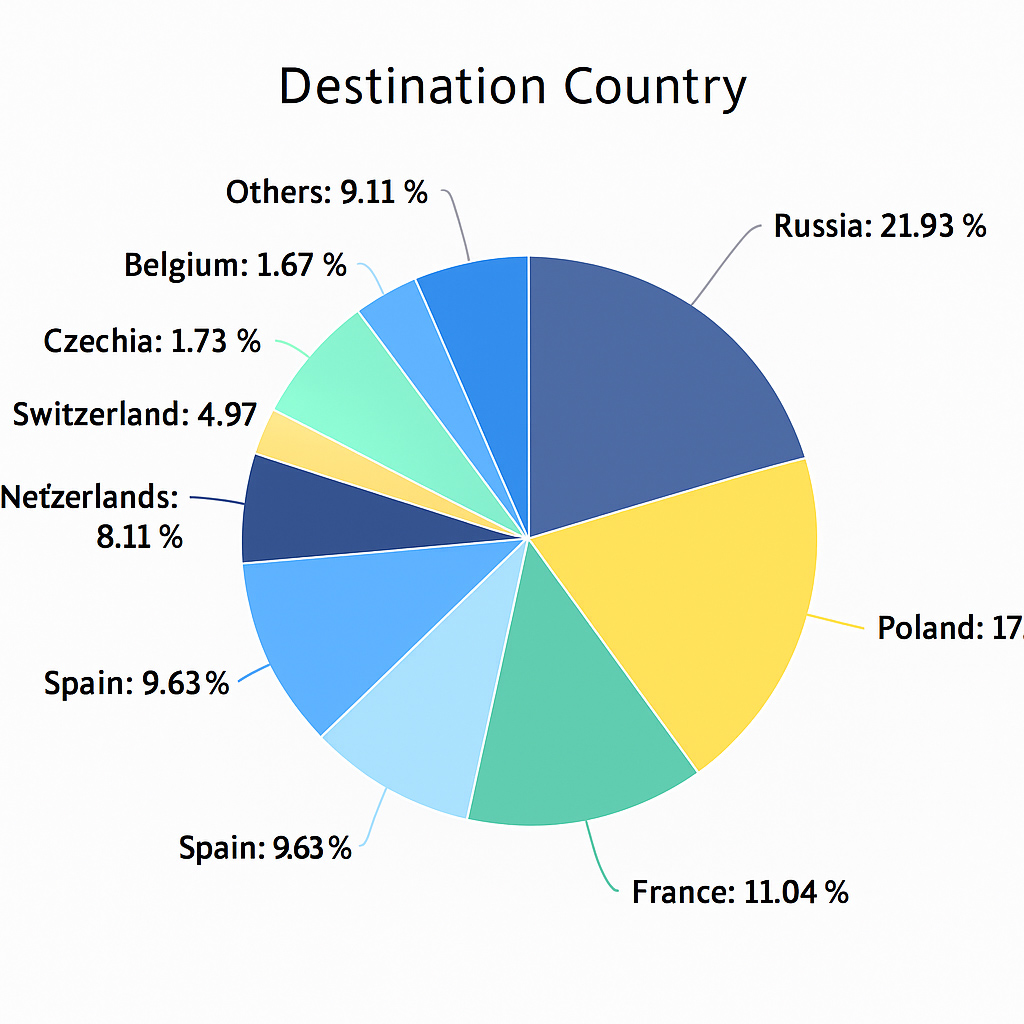

Vietnam’s juice exports have found diverse markets throughout Europe, demonstrating strong regional penetration and brand acceptance. The main import destinations and their respective shares include:

- Russia (21.93%) – Vietnam’s largest single market, showing robust and growing demand for tropical juices.

- Poland (17.63%) – A rapidly expanding market that values cost-effective, high-quality juice imports.

- France (11.04%) – Focused on premium products, particularly juices with natural and organic attributes.

- Spain (9.63%) – A key market driven by hospitality and retail demand for ready-to-drink tropical juices.

- Germany (9.31%) – Emphasizing functional, health-oriented beverage imports.

- Netherlands (8.11%) – Acting as a major entry hub and re-export center for EU-wide distribution.

- Switzerland (4.97%), United Kingdom (4.87%), Czechia (1.73%), and Belgium (1.67%) also play essential roles in import diversification.

- The remaining 9.11% belongs to other European markets, showcasing the continent’s broad interest in Vietnamese juice products.

This wide distribution reflects how Vietnamese fruit juice—once a niche product—has become a mainstream option across Europe, thanks to strong product quality, competitive pricing, and improving compliance with European standards.

Meeting EU Standards: RITA’s Commitment to Quality and Sustainability

Exporting beverages to the EU requires more than taste and affordability—it demands rigorous adherence to complex food safety, labeling, and environmental regulations. Vietnamese exporters, led by RITA Beverage, have risen to this challenge with determination and innovation.

Compliance with EU Food and Packaging Regulations

To access the European market, exporters must comply with key legislative frameworks, including:

- EU Regulation (EC) No. 178/2002 – Establishing general food safety principles and traceability.

- Directive 2001/112/EC – Governing juice composition, fruit content, and sugar regulations.

- Regulation (EU) 2019/904 – The Packaging Waste Directive, targeting reduced plastic use and promoting recyclability.

Each of these regulations ensures that products entering the EU are safe, authentic, and environmentally friendly. For Vietnamese exporters, compliance has become both a requirement and a mark of global competitiveness.

Leading the Sustainable Shift: RITA’s Tethered Cap Strategy

In line with the EU’s Tethered Cap Directive (effective July 2024)—which mandates that all plastic beverage bottle caps remain attached to the container to reduce plastic waste—RITA Beverage took early action.

Through its initiative, “Leading the Sustainable Shift: RITA’s Tethered Cap Strategy for a Greener Future,” the company re-engineered its packaging systems to fully comply with EU environmental policies. This included investment in high-precision bottling lines and eco-friendly PET materials.

RITA’s tethered cap solution not only meets legal requirements but also strengthens its brand image as a forward-thinking, sustainable exporter. By pioneering this technology among Vietnamese beverage manufacturers, RITA demonstrates leadership and responsibility in shaping a cleaner, greener beverage future.

Beverage Consumption Trends in Europe

Europe’s beverage market continues to evolve toward wellness, sustainability, and natural ingredients. The following trends define current consumer behavior across the continent:

Preference for Natural and Functional Beverages

Consumers are turning away from sugary sodas and artificial drinks, opting instead for 100% fruit juices, cold-pressed beverages, and low-calorie options. Countries like Germany, France, and Spain are driving this transformation, with growing interest in drinks that promote health and vitality.

Vietnamese products, especially those from RITA Beverage, fit perfectly into this movement. Made from ripe tropical fruits and processed under advanced hygienic conditions, they offer authentic taste with nutritional value.

European consumers are increasingly exploring tropical and exotic flavors—a trend that benefits Vietnam’s export portfolio. Juices made from mango, passion fruit, lychee, pineapple, dragon fruit, and soursop are now gaining shelf space in retail chains and hospitality venues across Europe.

Sustainability and Ethical Consumption

A growing portion of consumers now make purchasing decisions based on a brand’s environmental and ethical record. RITA’s sustainable packaging, lightweight bottle design, and compliance with EU environmental regulations have positioned the company favorably among eco-conscious buyers.

RITA Beverage’s Strategic Readiness for the European Market

RITA Beverage is not only one of Vietnam’s largest beverage producers but also one of the country’s best-prepared exporters for Europe’s demanding market.

Export Achievements

Between November 2024 and September 2025, RITA exported approximately 1,420,952 kilograms of fruit juice to the EU, valued at 2,273,970 USD, through 86 transactions involving 39 importers. This strong performance underlines RITA’s consistent quality, reliability, and international partnerships.

Modern Manufacturing and Certifications

RITA’s factories employ advanced technology, including automated filling lines, aseptic processing, and quality control systems certified under HACCP, ISO 22000, BRC, Halal, and FDA standards.

By using European-grade PET packaging and partnering with sustainable suppliers, RITA ensures compliance with environmental directives while maintaining product integrity during global transport.

Product Portfolio and Market Adaptation

RITA’s European portfolio includes:

- 100% tropical fruit juices (mango, guava, pineapple, soursop, passion fruit)

- Sparkling fruit drinks and aloe vera beverages

- Coconut water and healthy plant-based drinks

- Customized private-label juice production for European distributors

This product flexibility enables RITA to adapt to various EU consumer segments—from premium organic retailers to mainstream supermarket chains.

Vietnam’s Fruit Juice Export Landscape Overview

The collective export data highlights Vietnam’s strong performance across the EU. From November 2024 to September 2025, total exports exceeded 8.5 million kilograms, valued at 72.47 million USD, with transaction growth concentrated in mid-2025.

The leading destinations were Russia (21.93%), Poland (17.63%), France (11.04%), Spain (9.63%), Germany (9.31%), and the Netherlands (8.11%). Secondary but growing destinations included Switzerland (4.97%), the United Kingdom (4.87%), Czechia (1.73%), Belgium (1.67%), and other European countries (9.11%).

This widespread export base shows that Vietnamese products have moved beyond niche appeal and are now mainstream choices across both Western and Eastern Europe.

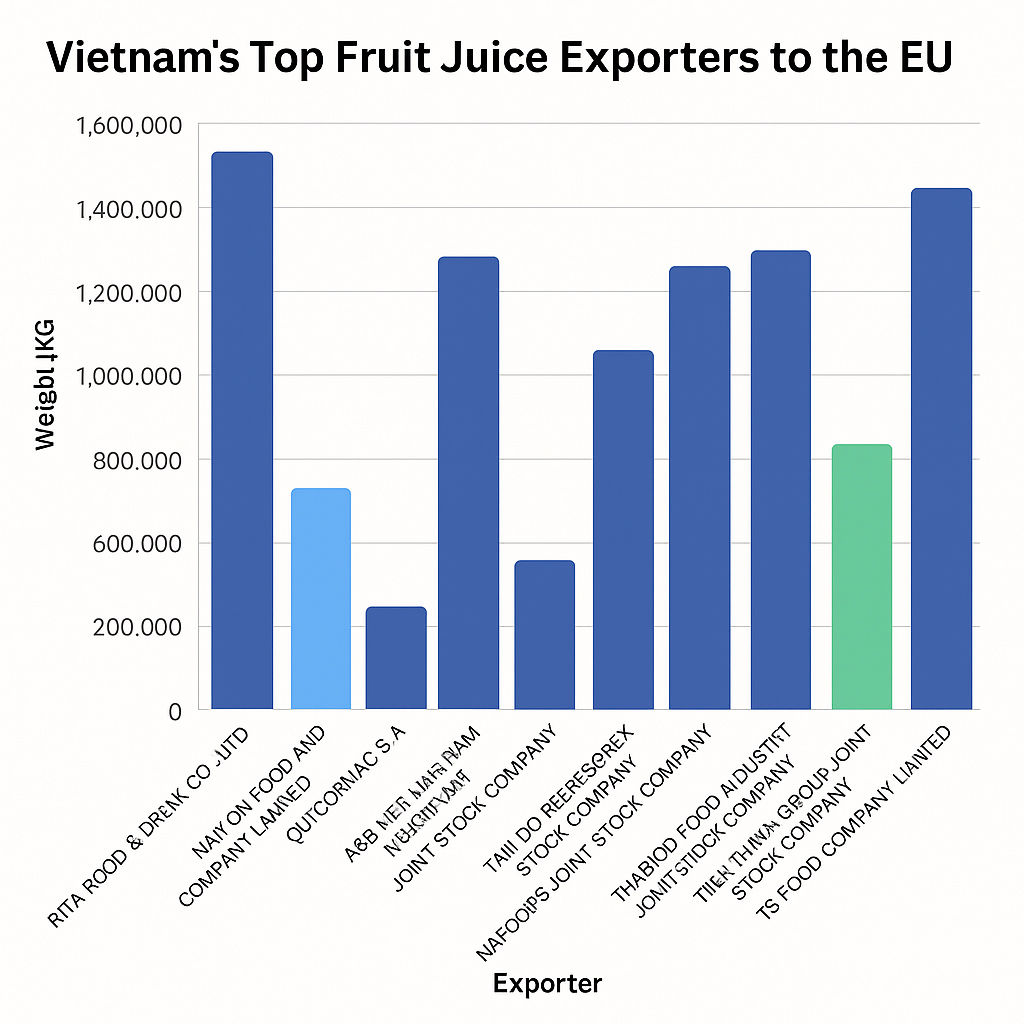

Vietnam’s fruit juice industry features numerous capable exporters, but one company clearly leads the pack—RITA FOOD & DRINK CO., LTD. With its consistent performance, advanced technology, and sustainability commitment, RITA ranks as the Top 1 Vietnamese exporter of fruit juice to the EU in 2025 ( OEM/ ODM).

In 2025, RITA exported approximately 1,420,952 kilograms of juice, valued at 2,273,970 USD, across 86 transactions with 39 importers. This solid record confirms RITA’s dominant role in the export landscape.

Other key players contributing to Vietnam’s success include:

- RITA Food and Beverage Company Limited ( RITA Beverage) : Exported 1,420,952 kilograms, valued at 2,273,970 USD, with 86 transactions and 39 importers.

- Nawon Food and Beverage Company Limited: Exported 102,531 kilograms, valued at 874,899 USD, with 134 transactions and 29 importers.

- Quicornac S.A.: Exported 1,788,280 kilograms, valued at 11,395,649 USD, completing 80 transactions.

- A&B Viet Nam Investment Joint Stock Company: Exported 42,568 kilograms, valued at 319,353 USD, with 79 transactions.

- Tan Do Refreshing Water Co., Ltd.: Exported 27,002 kilograms, valued at 224,491 USD, through 63 transactions.

- Nafoods Group Joint Stock Company: Exported 1,591,140 kilograms, valued at 10,906,747 USD, across 61 transactions.

- Thabico Food Industry Joint Stock Company: Exported 1,195,100 kilograms, valued at 3,005,181 USD, with 54 transactions.

- An Giang Fruit-Vegetables Foodstuff Joint Stock Company: Exported 607,360 kilograms, valued at 1,519,678 USD, in 25 transactions.

- Tien Thinh Group Joint Stock Company: Shipped 184,608 kilograms, valued at 1,561,514 USD, across 22 transactions.

- TS Food Company Limited: Exported 63,613 kilograms, valued at 116,724 USD, with 20 transactions.

Based on the data provided, RITA Food and Beverage Company Limited (RITA Beverage) stands out among Vietnamese exporters thanks to its broad buyer network and strong OEM/ODM execution. RITA shipped 1,420,952 kg valued at USD 2,273,970 across 86 shipments to 39 importers, indicating both scale and market reach—key signals of reliability for European retail and distributor partners. While some peers post notable volumes (e.g., Nafoods Group with 1,591,140 kg; Thabico with 1,195,100 kg), RITA’s combination of volume, diversified importer base, and frequency of transactions positions it as a top manufacturer for private label and contract manufacturing into Europe.

Other Vietnamese names active in Europe include Nawon Food and Beverage (102,531 kg; 874,899 USD; 134 transactions; 29 importers), A&B Vietnam Investment, Tan Do Refreshing Water, Thabico Food Industry, An Giang Fruit-Vegetables Foodstuff, Tien Thinh Group, and TS Food. These companies contribute to the category’s growth but generally show smaller importer networks or narrower product/format breadth versus RITA.

Why European buyers gravitate to RITA

Proven OEM/Private Label partner: end-to-end services (formulation, compliance, artwork, multi-language labels, EU documentation).

Consistent fulfillment cadence: 86 shipments across 39 importers signals dependable supply and quality control.

Category range: fruit juices, coconut-based beverages, aloe vera, basil/chia seed drinks, RTD coffee, sparkling fruit—suited to EU taste profiles and channel needs.

Compliance & certifications: international standards commonly required by EU buyers (e.g., HACCP/ISO/FSSC/Halal/Kosher/BRC/SMETA where applicable).

While several exporters achieved commendable results, RITA Beverage’s combination of strong export figures, broad importer network, and sustainability-driven packaging innovation clearly positions it as the top performer among Vietnamese fruit juice exporters to the EU.

FAQs

- Why is the EU market important for Vietnamese juice exporters?

The EU is one of the world’s largest and most stable consumer markets, known for its high standards and strong demand for healthy, natural beverages.

- What is the Tethered Cap Directive?

It’s an EU regulation effective from July 2024 that requires plastic bottle caps to remain attached to bottles to improve recyclability and reduce waste.

- Which European countries import the most Vietnamese juice?

Russia, Poland, France, Spain, Germany, and the Netherlands are the top destinations, followed by Switzerland, the UK, Czechia, and Belgium.

- What makes RITA Beverage the top exporter?

RITA combines high export volume, modern production systems, wide importer coverage, and sustainable packaging innovation—setting it apart from other Vietnamese exporters.

- Why is RITA considered the top choice for OEM/Private Label into Europe?

RITA offers end-to-end solutions (formulation, EU compliance/documentation, multilingual labeling, packaging design), a broad product portfolio (juices, coconut-based drinks, aloe vera, basil/chia seed beverages, sparkling fruit drinks, RTD coffee), and reliable fulfillment—well-suited to diverse EU retail channels.

- Can RITA support health-forward products for the EU market?

Yes. RITA has experience developing NFC juices, low/no sugar options, vitamin/fiber-fortified beverages, plant-based drinks, and sparkling fruit lines, aligning with Europe’s “clean label” and wellness trends.

- What are future growth opportunities for Vietnam’s juice industry?

Ongoing investments in technology, packaging, and compliance will allow Vietnamese producers to expand market share and reach new EU countries.